In the bustling world of business, especially for those offering subscription-based services or products that rely on repeated customer engagement, understanding and managing churn is crucial. Churn happens when customers stop using your service or product. For businesses, especially those with subscription models, this can significantly impact growth and profitability. Predicting churn means identifying the signs that a customer is likely to leave so you can take action to keep them. This article simplifies the concept of churn prediction and explores four distinct methods to measure churn, making it easier for business owners and sales and marketing professionals to grasp and apply these insights to reduce churn effectively.

How To Calculate Churn?

1. Standard Churn Rate: The Basic Measure

The Standard Churn Rate is your starting point for understanding churn. Imagine your business as a bucket of water, where the water level represents your customers. The standard churn rate is like measuring how much water leaks from the bucket over a specific period, say a month or a year.

- How to Calculate: Simply take the number of customers who have left during the period and divide it by the total number of customers at the start of the period. Multiply by 100 to get a percentage.

- Why It Matters: This method offers a straightforward snapshot of customer retention and loss. It’s essential for any business to know this basic health indicator. For example, if you start January with 100 customers and lose 5 by the end of the month, your standard churn rate for January is 5%.

2. MRR Churn: The Revenue Perspective

MRR (Monthly Recurring Revenue) Churn goes a step beyond by focusing on how churn affects your revenue, especially vital for businesses with various pricing plans or subscription levels.

- How to Calculate: This involves looking at how much recurring revenue you lost due to cancellations or downgrades, minus any upgrades that occurred in the same period.

- Why It Matters: It gives you a clearer picture of churn’s financial impact. If a high-value customer downgrades their plan or cancels, it could hurt more than losing a few lower-value customers. This measure helps prioritize retention efforts based on revenue impact rather than just customer count.

3. Activity (Event-Based) Churn: Beyond Subscriptions

For services that don’t operate on a subscription basis, Activity Churn is a way to gauge engagement and retention. It identifies customers who are no longer active or engaging with your product or service.

- How to Calculate: Define what active engagement looks like for your service (e.g., logging in, making a purchase) and then track who hasn’t met this criterion within your chosen timeframe.

- Why It Matters: It highlights the importance of engagement in customer retention. For businesses without clear subscription models, this can be a crucial way to understand customer behavior and identify those at risk of churning.

4. Net Churn: A Comprehensive Look

Net Churn combines aspects of the Standard and MRR churn rates, offering a more nuanced view by considering new revenue from existing customers (through upsells) against lost revenue from churns and downgrades.

- How to Calculate: You’ll consider the revenue lost from churned or downgraded customers and subtract the revenue gained from upgrades in the same period.

- Why It Matters: This method provides a holistic view of how churn affects your business’s revenue, taking into account both losses and gains. It’s especially useful for evaluating the effectiveness of upselling strategies and understanding the net impact of churn on your business’s growth.

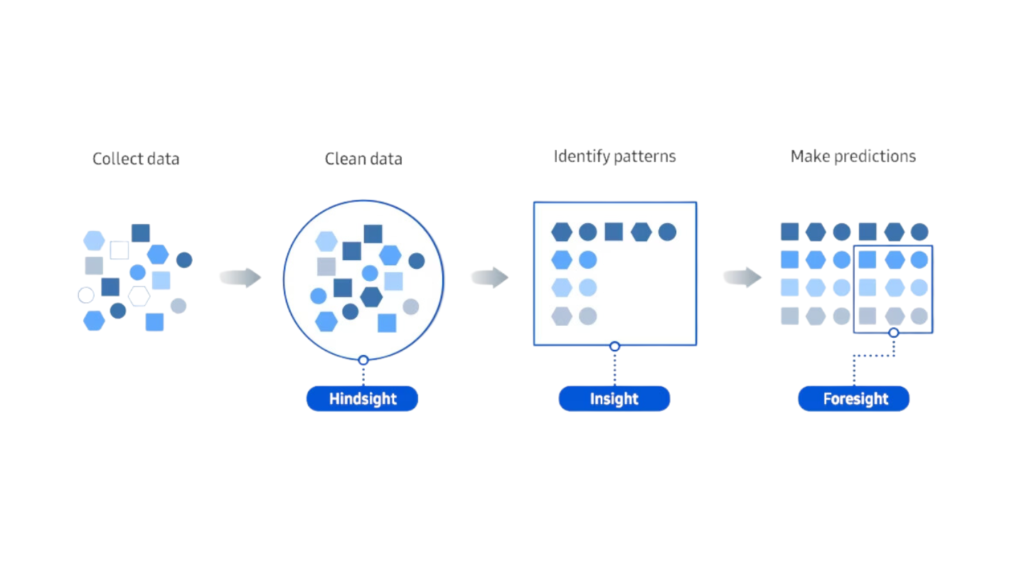

Predictive analytics is vital for businesses, transforming data into proactive measures to protect the customer base and stabilize revenue.